Microsoft’s Quasi-acquisition of OpenAI: Clever Circumvention of Antitrust Scrutiny?

Analysis of whether this unusual deal structure is subject to pre-close antitrust clearance

Everyone is talking about the unusual deal structure behind Microsoft’s expected $10 billion investment in OpenAI. VCs and lawyers have never seen a deal like this. Some are asking whether the deal is anti-competitive. But unlike Microsoft’s acquisitions of Activision and Nuance, here no one is predicting whether antitrust regulators will challenge the deal.

Does the deal structure allow Microsoft to bypass the antitrust review process that would accompany any other $10 billion acquisition? If so, will we start seeing more of these deals?

Deal structure review

The main features of the expected deal, along with prior agreements, include:

Profit-sharing: Under the expected deal terms, Microsoft receives 49% of OpenAI’s future profits once OpenAI pays back its early investors.

Exclusive licensor: In 2020, Microsoft becomes the exclusive licensor to OpenAI’s GPT-3 model.

Exclusive cloud vendor: In 2019, as part of the $1 billion investment, Microsoft becomes OpenAI’s exclusive cloud provider, valued at more than hundreds of millions of dollars per year. Today, OpenAI models depend on Microsoft software and hardware to run, making it hard for OpenAI to switch to a different cloud vendor.

What doesn’t Microsoft get? Microsoft may not have control. But what additional benefit does control give Microsoft when it has a large profit-share and an exclusive license?

Consider the FTC’s challenge of Microsoft’s acquisition of Activision: Let’s say that instead of acquiring Activision, Microsoft became the exclusive licensor to Activision games and took significant portion of Activision’s profits. Would a deal like that pose less competitive harm than an acquisition? Unlikely. Exclusivity is precisely the FTC’s concern in its complaint against Microsoft/Activision.

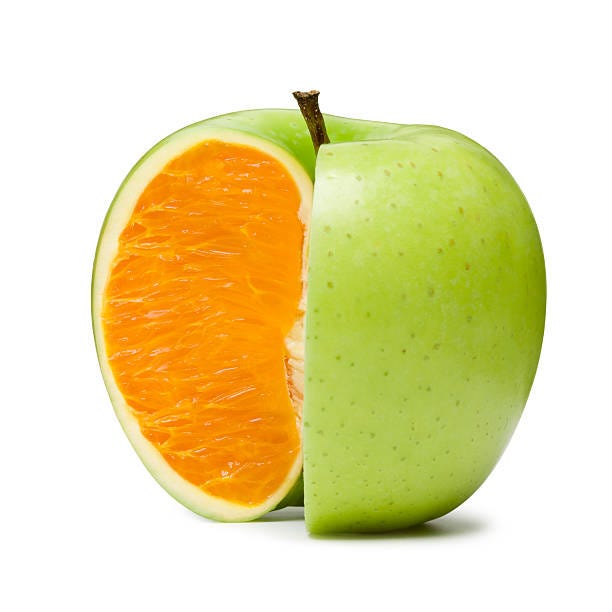

Similarly, any competitive harm arising from Microsoft’s expected deal with OpenAI wouldn’t differ meaningfully from a traditional acquisition. So antitrust scrutiny between the two shouldn’t differ. But does it?

Pre-merger antitrust notification framework

Every year, US government lawyers review thousands of proposed mergers and acquisitions for competitive harm before they are allowed to close. Parties to those deals must submit an information packet that includes all emails, decks, and other documents that evaluate the transaction with respect to competition and the market. The government then reviews the packet and either clears the deal or investigates it, asking the parties for more information. Of the deals reviewed, usually less than 5% are investigated. Recently investigated tech mergers include Microsoft/Activision, Adobe/Figma, and Visa/Plaid.

Not all deals are subject to reporting. To figure out whether a deal is reportable, parties (with the help of their lawyers) comb through a highly technical, constantly expanding maze of rules called the HSR Act.

So, what deals qualify for reporting? Let’s walk you through some parts of the maze.

Acquisitions of voting securities or assets valued over $101 million (the current threshold) generally require a pre-merger filing and regulatory approval unless an exemption applies. The HSR Act captures more than just M&A deals that transfer control. For example, preferred stock financings and other minority stock acquisitions as well as exclusive patent license transfers that exceed the $101 million threshold can be reportable. On top of that, the HSR Act includes a list of exemptions. Parties don’t have to report exempt deals.

Common exemptions, in a simplified nutshell, include:

Passive investor exemption: applies to acquisitions of up to 10% of a company’s equity made for investment purposes only and not to steer basic business decisions. To qualify, parties cannot be competitors, serve on each other’s boards, propose corporate actions requiring shareholder approval, etc.

Pro rata exemption: applies where existing investors exercise their pro rata rights in a subsequent funding round to maintain rather than increase their share of the company.

“Size of person” threshold not met: applies to transactions under around $400 million when the target has assets and sales below certain thresholds.

Unlike minority acquisitions of corporate stock, minority acquisitions of non-corporate entities (such as LPs and LLCs) are not reportable, regardless of value. Investments in non-corporate entities become reportable only when the deal gives the investor a right to 50% or more of profits or assets upon dissolution.

Application of antitrust rules to Microsoft’s investment in OpenAI

If OpenAI were a corporation with voting securities and shareholders, then Microsoft’s $10 billion investment would almost certainly trigger a filing to the antitrust agencies, along with a $2.25 million filing fee. The investment would be a minority stock investment that exceeds the reporting thresholds. An exemption would be unlikely to apply. Microsoft would have too big a stake and be too entwined in joint product development to qualify as a passive investor. Plus, OpenAI’s technology likely competes to some extent with Microsoft’s own AI models. The pro rata investor exemption is also unlikely to apply given the funding amounts and valuations of the expected deal compared to the 2019 deal.

However, OpenAI is not a for-profit corporation. So, the minority stock investment analysis does not apply. OpenAI consists of a nonprofit parent that governs several LP and LLC subsidiaries. In 2019, four months before we heard about Microsoft’s first investment, OpenAI created OpenAI LP, the entity that Microsoft later invested in. In the expected deal, Microsoft will likely invest in an OpenAI LP or LLC subsidiary again. After all, the nonprofit parent cannot distribute profits to investors. Thus, the HSR rule for non-corporate interests will apply: for the deal to be reportable, it must give Microsoft the right to 50% or more of OpenAI’s profits. The expected deal gives 49%.

Take-aways

Of course, any deal by Microsoft—reportable or not—will attract antitrust regulators in droves. The DOJ and FTC can and do investigate and challenge deals (and other conduct) outside the HSR filing process.

But I wonder if we’ll see more deal structures like this, which can save parties from a long, costly process and reduce the odds of antitrust scrutiny—or if the HSR rules will soon change to cover this apparent loophole.

Is Lina Khan and the DOJ aware of this? I thought of this exactly. Microsoft is buying OpenAI. Even the way they are doing it is clever. The announce a $10 billion dollar investment and yet its not cash. Its computer time which they get to account for as revenue for Azure thus raising their standing compared to AWS.

I think the DOJ really needs to up the number of workers they have dedicated to antitrust investigation. The big tech companies continue to buy the upstarts that can challenge them.